IoT-related acquisitions are on the rise with no sign of slowing down. By June 2015, buyers had spent close to $15 billion to purchase almost 40 IoT companies. This number totaled $14.3 billion for 62 companies in all 2014. So, if the trend continues, the total dollar value spent on the acquisition of these companies will be twice as big this year compared to last year. It is also important to notice that in average, target companies have been valued at $375 million in 2015 compared to only $231 million in 2014. This means that they have been valued by almost 60% higher than a year earlier. (We will talk about different ways of valuation in a future blog post)

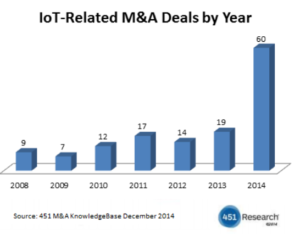

The following diagram shows the trend from 2008 to the end of 2014:

Most (if not all) of these deals are strategic acquisitions, for quick access to a solution that is well-aligned with the strategy of the buyer. In almost all cases, the buyer itself funds the startup and invests heavily in it, and has a representative on the board to control or influence the decisions, without becoming distracted from its core activities.

Google’s acquisition of Lab Nests in January 2014 was a very good example of a big opportunity being seized in a strategic and well-thought move. Other such examples include the Samsung acquisition of SmartThings, Facebook acquisition of Oculus, and Intel buying Basis Science. Google’s acquisition of Lab Nests is very interesting for many reasons, including and specifically because of perfect alignment to Google’s strategy. Google is very well positioned to benefit from the two major perspectives of the IoT: selling the solution itself, as well as gathering the data and monetizing it in different ways, especially advertisements. In fact, the four main verticals that Google is targeting including connected (driverless) cars, robotics, smart homes, and wearable devices target a wide-enough market to gather information about people’s habits, their daily lives, products and services they use, and even products and services that they need, but do not know of yet! An automated home solution, for example, will gather data about the appliances being used at home, trend of usage, the conditions of the appliances (if they need to be serviced or replaced), therefore consumer’s behavior, interest and consumption patterns. Information will be highly valuable for accurately targeted advertising. Wearable devices, on the other hand, will collect data about your body and your health. Data may be used in many different ways. Systems could alarm you well in advance if you are developing unhealthy conditions, which might lead to a stroke or Alzheimer’s (let’s say if you are misplacing and searching for the connected things more often than before, or show signs of unintelligence as you work on the internet and with the “connected devices”). On the other hand, insurance companies might use the same data to raise your insurance premiums, or insure people based on their family health background or habits! Insurance companies may track your driving style and routes to adjust your car insurance rates too. Possibilities are endless; so are the opportunities for Google as the owner of all the collected data, as a search engine, as an advertising channel, and as a solution provider. Now Google is again addressing one of its major flaws: Google didn’t own data initially and was merely a search engine. Now it owns loads of valuable data. Interestingly but not surprisingly, different companies may have different strategic approaches to IoT acquisitions, depending on the industry, their products and services, and where they are in the value chain. Samsung, Intel and Facebook for example are all interested in the IoT, but their strategies and their target companies to acquire are not exactly the same as Google. We will explain more in future posts.

So, in short, the trend in the acquisition of the IoT-related startups and small companies have accelerated, and will not stop any time soon. Sensors and their algorithms, RFID, small-size chips (MCUs), security solutions, data management, data mining and power management are becoming more exciting and attractive than ever. The more defined and clearer the strategy of giant companies across all industries are, the better they can target the right startups to purchase, and vice versa; startups and small businesses that have a clear strategy and know their target purchaser, may align their targets with those of the prospect acquirer, which will increase their chance of being acquired and at a higher value. This is one of the reasons, why many of the most successful and backed-up small and startup businesses are in fact founded by the ex-managers of the big companies, which will end up purchasing them back again.

Again, we will elaborate more on this subject this in future posts.